The Barking Post

Our Most Recent Blogs

First Time Car Buyer Tips – Our Top 9 Considerations

When you’re buying your first car, it’s natural to feel a little overwhelmed. Not only is this one of first major purchases you're going to make, but it's the first step to independence and a little more freedom in life. Whether you're using your new car to commute to work, [...]

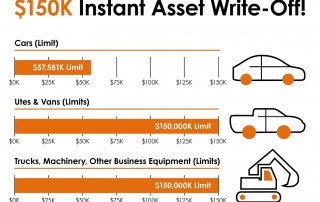

How to take Advantage of the Instant Asset Write Off

If you’re looking for a new asset for your business then there has never been a better time to buy. The instant asset write off is a great incentive for businesses to buy equipment or vehicles now along with some record low interest rates. The commercial finance brokers at CarBeagle [...]

The Guide to the SME Guarantee Scheme

In response to the economic impact of the Coronavirus – the federal government has recently announced a new stimulus assistance package called the SME Guarantee scheme to help businesses grow and survive through the pandemic. The SME Guarantee scheme is designed to provide businesses with much needed access to working [...]

The 2020 Guide to the Instant Asset Write Off

In response to the economic impact of the Coronavirus - the federal government has just announced a new and improved instant asset write-off initiative which is even bigger and better than last financial year. Business owners looking to buy assets worth less than $150,000 can now instantly write them off [...]

Best 7-Seater SUVs in Australia

If you’re looking to buy a new car with plenty of space, it’s hard to look past some of the best 7-seater SUVs in Australia. Whether you’ve got a big family or you simply want a heap of space, we’ve got some hot tips on some of the best 7-seaters [...]

Why Should I Buy a Mid Size SUV?

The used car market can sometimes be a difficult landscape to navigate. That’s why CarBeagle is here to help you along the way. In this article we’ll be discussing some of the key benefits of buying a mid size SUV. They’re all the rage in Australia, so if you’re considering [...]

Understanding your credit score

If you’re in the market for any type of finance then you may have heard the term credit score thrown around. So what does is actually mean? A credit score is a number or rating which is unique to you. It is based off all the information available on your [...]

The Top 3 Caravans People Are Buying Today

Australians love the great outdoors. We always have, and we always will. With so much land to explore, it’s little wonder that we’re also pretty crazy about caravans and leisure vehicles. What better way to see this great country than by getting out on the open road? But it can [...]

It’s A Subscription World

The concept of a subscription service isn’t new. Historically people were first introduced to the idea when we all decided we needed to lose a few kilos. With the promise of washboard stomachs and bulging biceps, we signed up with fortnightly direct debits lasting well beyond the time we actually [...]

5 Reasons to Buy a Toyota Corolla

If you’re in the market for a new car, you’ve got a huge range of options in front of you. New car? Used? How old do you want a used car to be? Then there’s all the financial questions. How you’re going to obtain car finance, and can you afford [...]